GSDP share as criterion for central–State transfers

The Hindu

Core Theme and Context

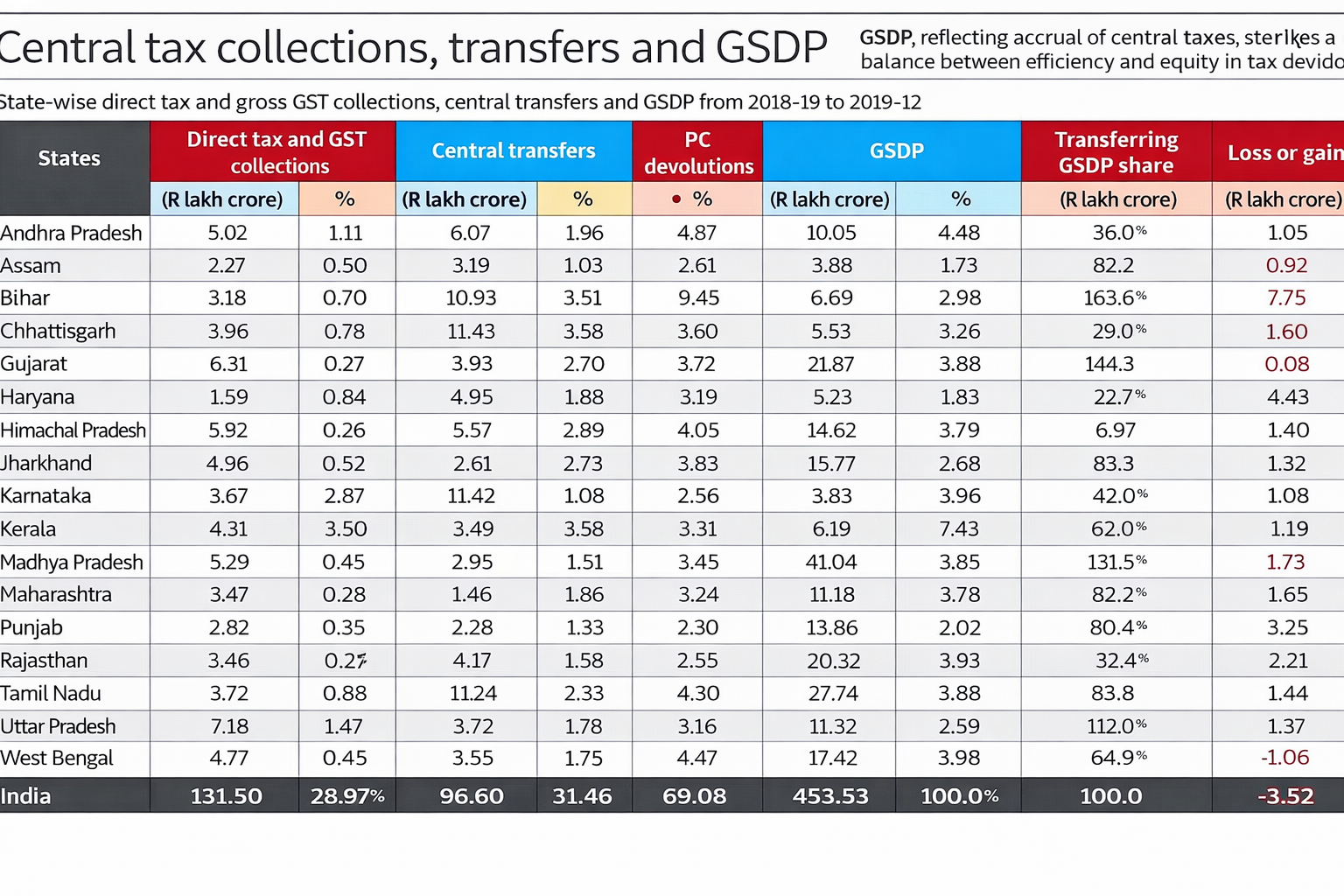

The article examines the proposal to use Gross State Domestic Product (GSDP) share as a criterion for Centre–State fiscal transfers, situating it within India’s evolving framework of fiscal federalism after the abolition of the Planning Commission and the enhanced role of the Finance Commission.

The central question is whether GSDP-based allocation promotes fairness, efficiency, and cooperative federalism, or whether it risks reinforcing regional inequalities and distorting incentives.

Key Arguments Presented

1. Rationale for Using GSDP as a Criterion

The article argues that GSDP reflects:

- Economic size and contribution

- Revenue generation capacity

- Absorptive ability of States

Using GSDP, therefore, appears logical for allocating central funds, particularly for schemes requiring scale, co-financing, and administrative capacity.

2. Risk of Penalising Poorer and Smaller States

A major concern highlighted is that GSDP-based transfers may favour richer, high-growth States, while disadvantaging:

- Economically weaker States

- Hill and northeastern States

- States with structural constraints

This challenges the redistributive objective of fiscal transfers, which traditionally aim to correct horizontal imbalances.

3. Departure from Equity-Oriented Federal Principles

The article situates the debate against constitutional principles that prioritise:

- Equity

- Need-based transfers

- Balanced regional development

Excessive reliance on GSDP risks shifting transfers from equalisation logic to contribution logic, which may be more appropriate for tax devolution debates than grants-in-aid.

4. Interaction with Existing Finance Commission Criteria

The article notes that Finance Commissions already use a multi-criteria formula including income distance, population, area, forest cover, and demographic performance. Introducing GSDP dominance may:

- Distort this carefully balanced framework

- Overlap with or dilute redistributive weights

5. Political Economy and Federal Trust

Beyond technical aspects, the article highlights the political implications:

- Perception of bias against poorer States

- Reinforcement of North–South and Centre–State tensions

- Risk of weakening cooperative federalism

Fiscal transfers are not merely financial instruments but also signals of trust and partnership.

Author’s Stance

The author adopts a cautiously critical stance:

- Recognises the efficiency and transparency arguments for GSDP use

- Strongly warns against its over-emphasis

- Advocates balance between efficiency and equity

The tone is analytical and federalism-sensitive rather than ideological.

Implicit Biases and Editorial Leanings

1. Equity-Centric Bias

The article prioritises redistribution and regional balance, potentially underplaying:

- Incentive effects for growth and fiscal discipline

- Legitimate demands of contributor States

2. Skepticism of Market Logic in Federal Transfers

There is an implicit discomfort with using economic output as a primary determinant, reflecting a preference for welfarist federal design.

3. Status-Quo Preference

The article tends to defend existing Finance Commission frameworks, with limited exploration of whether they need reform to reflect changing economic realities.

Pros and Cons of the Argument

Pros

- Strong defence of equity in fiscal federalism

- Highlights risks of widening inter-State disparities

- Anchors debate in constitutional principles

- Highly relevant for Centre–State relations discourse

Cons

- Limited discussion on incentivising efficiency and growth

- Underplays fiscal stress in high-contributor States

- Less engagement with hybrid or phased approaches

Policy Implications

1. Need for Balanced Criteria

Fiscal transfers must balance:

- Equity (need and backwardness)

- Efficiency (capacity and performance)

- Incentives (growth, governance, fiscal prudence)

No single metric, including GSDP, can serve all objectives.

2. Strengthening Equalisation Role of Finance Commission

The article implicitly calls for reaffirming the Finance Commission’s role as:

- An equalising institution

- A buffer against regional divergence

3. Transparency and Consensus-Building

Any change in criteria must be:

- Data-transparent

- Consultative

- Sensitive to regional diversity

Real-World Impact

- Overuse of GSDP could widen regional inequality

- Poorer States may face reduced fiscal space for social spending

- Richer States may feel rewarded, but at the cost of federal cohesion

- Perception of fiscal unfairness could intensify political friction

For citizens, the issue affects quality of public services, development outcomes, and regional equity.

UPSC GS Paper Alignment

GS Paper II – Polity & Governance

- Centre–State relations

- Cooperative federalism

- Constitutional bodies

GS Paper III – Economy

- Fiscal federalism

- Public finance

- Intergovernmental transfers

GS Paper I – Society

- Regional disparities

- Balanced development

GS Paper IV – Ethics

- Equity vs efficiency

- Fairness in public resource distribution

Balanced Conclusion and Future Perspective

The article makes a persuasive case that GSDP should be used cautiously, not dominantly, in Centre–State transfers. While economic contribution and capacity matter, fiscal federalism in India is constitutionally designed to reduce disparities, not entrench them.

The way forward lies in:

- Retaining multi-dimensional transfer formulas

- Using GSDP as a supplementary, not overriding, criterion

- Ensuring that growth incentives do not undermine equity

Ultimately, fiscal transfers are not merely about numbers—they are about holding together a diverse Union through fairness, trust, and shared development.